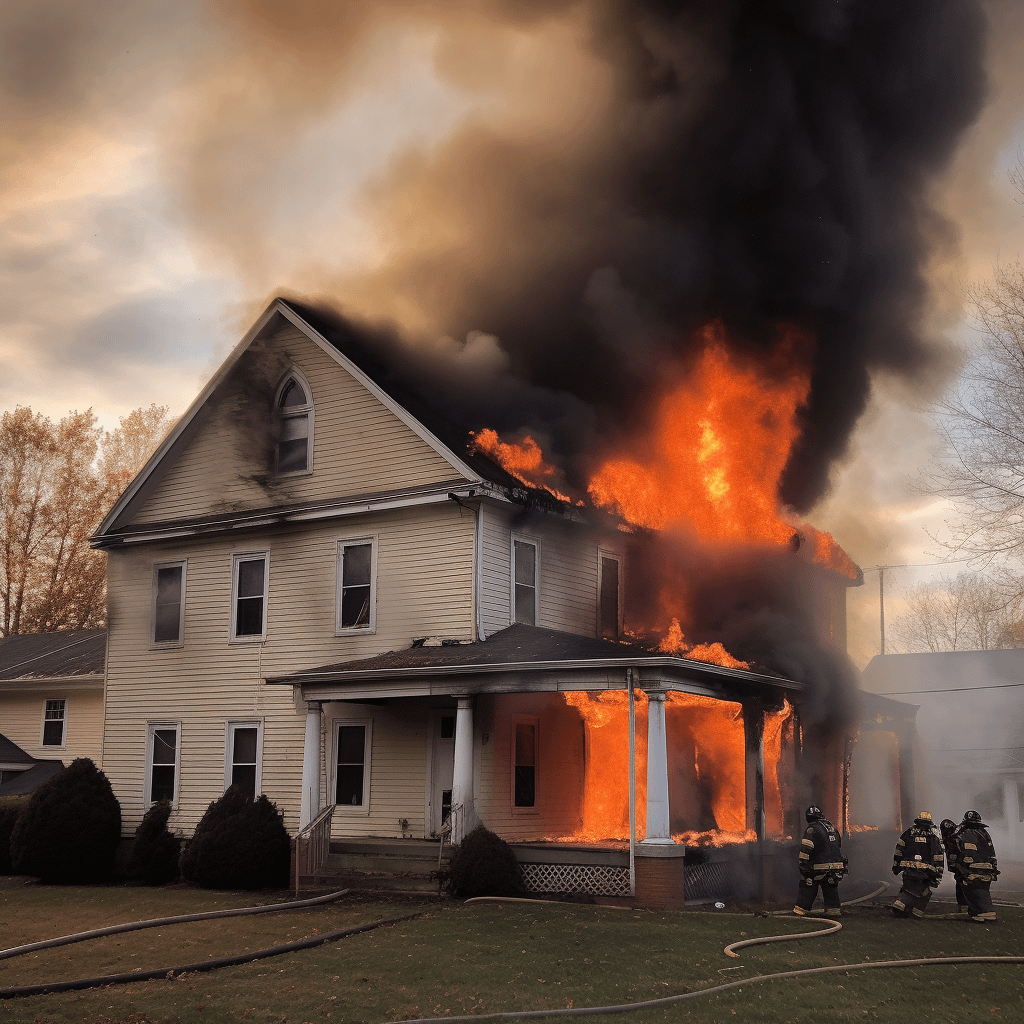

Fire can cause great damage. If your home catches fire, you may need help. Insurance can help cover the costs. But sometimes, insurance companies deny fire claims. This can be very frustrating. Let's look at why this happens.

Incomplete or Incorrect Paperwork

One main reason for denial is paperwork. Your claim must be clear and correct. If there are mistakes, your claim may be denied. Always double-check your forms. Make sure all details are accurate.

Policy Exclusions

Insurance policies have exclusions. These are things not covered by the policy. For example, some policies do not cover fires caused by arson. Always read your policy carefully. Know what is and isn't covered.

Failure to Pay Premiums

You must pay your premiums on time. If you miss payments, your coverage may lapse. This means you are not protected. Always pay your premiums by the due date. This keeps your coverage active.

Suspicion of Fraud

Insurance companies check for fraud. If they think your claim is false, they will investigate. Fraud can include lying about damages or starting the fire yourself. Always be honest. This will help your claim process smoothly.

Delayed Reporting

Report the fire as soon as possible. Delays can cause problems. Insurance companies may think you are hiding something. Report the fire right away. This will help your claim move quickly.

Lack of Evidence

You need to show proof of the fire and damages. Take pictures and keep records. If you have no evidence, your claim may be denied. Always gather as much proof as you can.

Violation of Policy Terms

Follow all policy rules. If you break a rule, your claim may be denied. For example, some policies require regular home maintenance. If you do not maintain your home, you may not be covered.

Unapproved Repairs

Do not make repairs before telling your insurance company. They need to see the damage first. If you make repairs, they may deny your claim. Always wait for approval before fixing anything.

Home Business

Running a business from home can affect your coverage. Some policies do not cover home businesses. If you have a home business, tell your insurance company. They may offer special coverage for this.

Illegal Activities

If the fire was caused by illegal activities, your claim may be denied. Always follow the law. This helps keep your coverage valid.

Acts of Nature

Some policies do not cover fires caused by nature. For example, wildfires may not be covered. Check your policy to see what types of fires are included.

Underinsured Property

Make sure your property is fully insured. If your coverage is too low, you may not get enough money. Always update your coverage to match your property value.

Non-Disclosure

Tell your insurance company everything. If you leave out details, your claim may be denied. Always be open and honest about your property and its risks.

Negligence

Take care of your property. If you are careless, your claim may be denied. For example, leaving candles unattended can be seen as negligence. Always follow safety rules.

Credit: www.wallaceinsurancelaw.com

Failure to Follow Safety Codes

Your home must meet safety codes. If it does not, your claim may be denied. Regularly check your home for safety. Fix any issues right away.

Commercial Use

If your home is used for business purposes, it may not be covered. Always tell your insurance company about any commercial use. They can offer special coverage for this.

Vacant Property

Vacant homes are at higher risk. Some policies do not cover vacant properties. If you leave your home empty, tell your insurance company. They may require extra coverage.

Credit: wylylawfirm.com

Summary

Insurance helps protect your home after a fire. But claims can be denied for many reasons. Always keep your paperwork correct. Pay your premiums on time. Be honest and follow all rules. Report fires right away and gather evidence. This will help your claim go smoothly.

Frequently Asked Questions

Why Do Insurance Companies Deny Fire Claims?

Insurance companies may deny fire claims due to policy exclusions, incomplete documentation, or suspected fraud.

What Are Common Reasons For Claim Denial?

Common reasons include lack of evidence, policy exclusions, and discrepancies in the claim.

How Can Incomplete Documentation Affect My Claim?

Incomplete documentation can lead to denial due to insufficient proof of damage or ownership.

Do Policy Exclusions Affect Fire Claims?

Yes, specific exclusions in your policy can lead to claim denial for certain fire-related damages.

0 Comments