Getting car insurance as a new driver can be one of the more stressful parts of beginning your driving journey. You’ll likely face higher premiums, unfamiliar terms, and lots of choices. But with the right strategies, you can find coverage that balances protection with affordability.

1. Why New Drivers Pay More

-

Insurers view new drivers (especially teens or drivers with less than a year of licensing) as higher risk. Statistics show younger drivers have more accidents, so premiums reflect that.

-

Premiums depend on many factors beyond your age: vehicle type, driving record (or lack of one), location, how much you drive, credit score (in many states), and coverage level.

-

Because you have less driving history, you don’t yet benefit from a “good driver” track record, which means fewer discounts and higher charges until you build experience.

2. Coverage Basics: What to Choose

When you’re shopping, here are some of the main decisions:

-

Liability vs Full Coverage: Minimum liability only covers damage you cause to others (depending on your state’s minimums). Full coverage usually includes collision and comprehensive, protecting your vehicle. Full coverage costs more but offers more protection.

-

Deductible: This is how much you pay out-of-pocket when you make a claim. A higher deductible → lower premiums, but more risk if you need to claim.

-

Choosing your vehicle matters: Safe, reliable, moderately priced vehicles cost less to insure. Sports cars or high performance models → higher insurance.

-

Discounts & special programs: Many insurers offer special discounts for new drivers who take certified driver education courses, maintain good grades, drive safely via telematics usage-based insurance.

3. Top Companies & What Makes Them Stand Out

There’s no “one size fits all” best insurer for all new drivers, but some companies are consistently well-rated for this group:

-

State Farm: Strong for new drivers with relevant discounts like “Steer Clear” for young drivers, good student discounts, and usage-based programs.

-

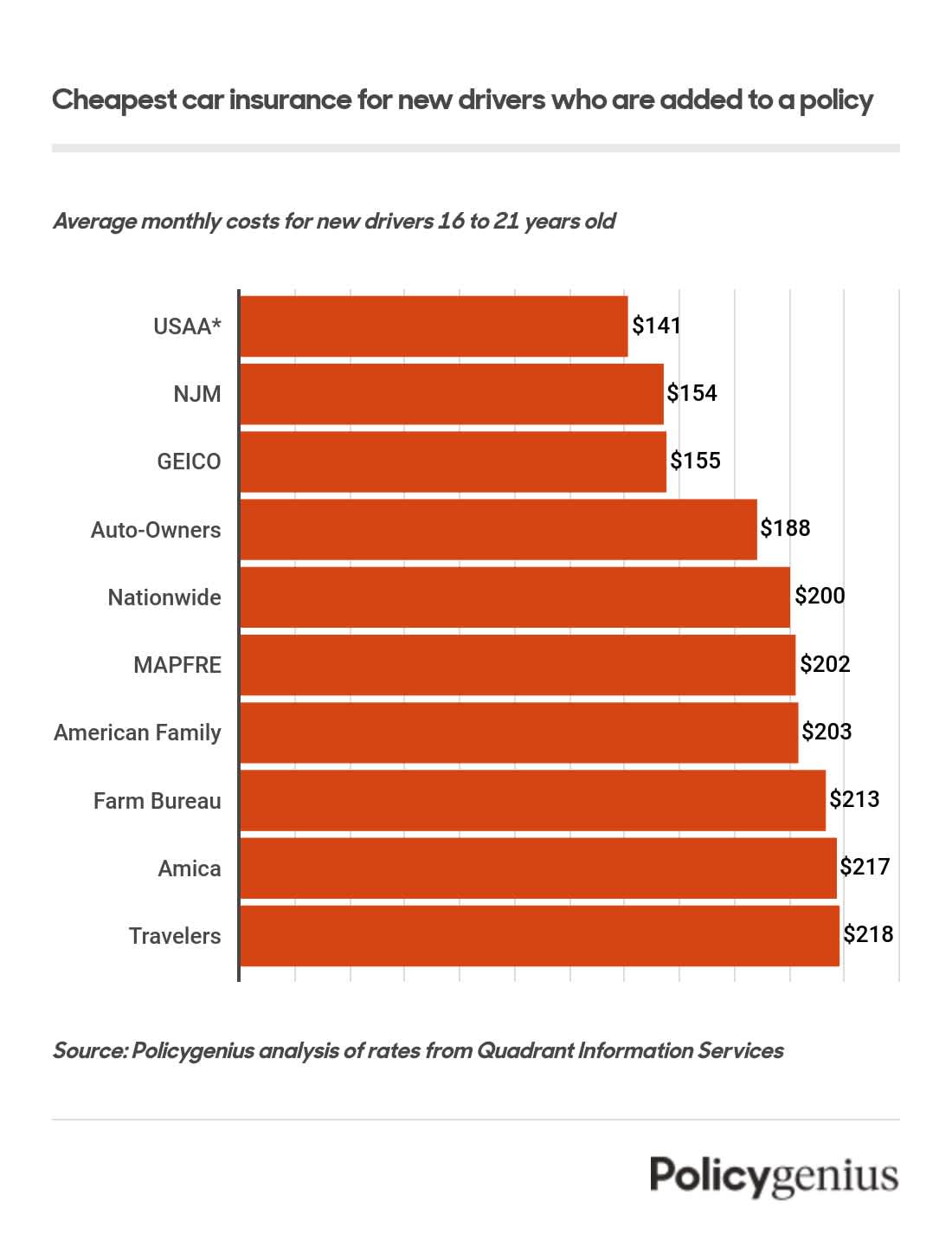

GEICO: Known for competitive pricing, strong online support, and broad availability.

-

Travelers: According to recent data, one of the most affordable for new drivers in many states.

When you’re comparing, be sure to check in your state, because rates vary significantly by state. What is affordable in one state may be much higher in another.

4. Smart Ways to Lower Your Premiums

Even though you’re a new driver and may face higher costs, there are several effective ways to reduce your insurance bill:

-

Stay on your parent’s policy (if possible): For many younger drivers under 25, being added to a family plan is cheaper than getting your own standalone policy.

-

Choose a safe, moderate car: Pick a vehicle with good safety ratings, moderate repair costs, and not a high-risk (sports) car.

-

Take a driver-education or defensive-driving course: These can not only make you a better driver, but also qualify you for discounts.

-

Enroll in telematics or usage-based programs: Some insurers allow apps or devices that monitor your actual driving behavior (speeding, braking, night-driving). Safe habits can earn you significant discounts.

-

Maintain good grades: If you’re a student, many insurers offer a “good student discount.”

-

Bundle policies: If your family also has renters or homeowners insurance, bundling with the same insurer may bring savings.

-

Pay upfront or choose auto-pay: Some discounts exist for paying the full premium or setting up automatic payments.

-

Shop around annually: Rates change, and your driving experience will improve. It’s wise to compare quotes year-to-year.

5. What To Do Before You Buy or Apply

-

Get multiple quotes: Don’t accept the first number you see. Use comparison tools or work with an independent broker so you can see many offers.

-

Check the vehicle’s insurance cost before buying: If you plan to purchase a car, ask insurers what the premium would be based on that car. That can influence your vehicle choice.

-

Understand your state’s minimum coverage requirements: Being under-insured can create serious financial risk if you’re in an accident.

-

Maintain your driving discipline from day one: A clean record yields better rates later; a ticket or accident can significantly increase your costs.

6. Final Thoughts

Being a new driver doesn’t mean you’re doomed to pay sky-high insurance forever. It’s true that you’ll start at a higher cost than someone with many years of clean driving history — but as you accumulate safe driving years, take advantage of discounts, and make smart choices about your vehicle and coverage, your insurance burden can drop significantly.

Focus on:

-

Choosing the right car

-

Completing driver education / safe driving

-

Staying on a good policy (family or your own)

-

Comparing insurers and coverage levels

-

Building your clean driving record

Over time, you’ll move from being treated as a “risk” due to inexperience into a valued low-risk driver, and your insurance costs should reflect that.

Are you a new driver? Finding the right insurance can be hard. New drivers often face high insurance costs. Insurance companies see them as risky. But don't worry. There are ways to find good, affordable insurance.

Credit: www.policygenius.com

Why Do New Drivers Pay More?

New drivers have less experience on the road. This makes them more likely to have accidents. Insurance companies charge more to cover this risk. Young drivers also face higher costs. They are more likely to be involved in accidents.

How to Find Affordable Insurance

Finding affordable insurance takes time. But it is possible. Here are some tips to help you:

- Shop around and compare quotes.

- Consider a car with lower insurance costs.

- Look for discounts and deals.

- Maintain a clean driving record.

- Take a defensive driving course.

Top Insurance Companies for New Drivers

Some insurance companies are better for new drivers. Here are a few to consider:

1. Geico

GEICO is known for its affordable rates. They offer discounts for good students. They also have a program for safe drivers.

2. State Farm

State Farm is a popular choice. They offer many discounts. Good students and safe drivers can save money. State Farm also has a program for new drivers.

3. Progressive

Progressive is another good option. They offer a range of discounts. Their Snapshot program can help you save. It tracks your driving habits. Safe drivers pay less.

4. Allstate

Allstate offers many discounts. Good students and safe drivers can save. They also have a program for new drivers.

5. Nationwide

Nationwide is a good choice for new drivers. They offer discounts for good students. They also have a program for safe drivers.

Credit: www.valuepenguin.com

Special Programs for New Drivers

Many insurance companies have special programs. These programs help new drivers save money. Here are a few examples:

Geico's Good Student Discount

GEICO offers a discount for good students. If you have good grades, you can save money on your insurance.

State Farm's Steer Clear Program

State Farm has a program called Steer Clear. It is for new drivers under 25. You need to complete a course and have a clean driving record.

Progressive's Snapshot Program

Progressive's Snapshot program can help you save. It tracks your driving habits. Safe drivers pay less.

Allstate's Teensmart Program

Allstate offers a program called TeenSMART. It is for young drivers. You need to complete a course to get the discount.

Nationwide's Smartride Program

Nationwide has a program called SmartRide. It tracks your driving habits. Safe drivers can save money on their insurance.

Choosing the Right Coverage

Choosing the right coverage is important. Here are some types of coverage to consider:

- Liability Coverage: This covers damage you cause to others. It is required in most states.

- Collision Coverage: This covers damage to your car from an accident.

- Comprehensive Coverage: This covers damage to your car from things like theft, fire, or weather.

- Uninsured/Underinsured Motorist Coverage: This covers you if you are hit by someone without insurance.

- Personal Injury Protection: This covers medical expenses for you and your passengers.

Final Tips for New Drivers

Here are some final tips to help new drivers:

- Drive safely and follow the rules of the road.

- Maintain a clean driving record.

- Take a defensive driving course.

- Look for discounts and deals.

- Choose the right coverage for your needs.

Finding the best insurance for new drivers takes time. But it is worth it. By following these tips, you can find affordable and reliable coverage.

Frequently Asked Questions

What Type Of Insurance Is Best For New Drivers?

Liability insurance is a good choice. It covers damages to others if you're at fault.

How Can New Drivers Save On Insurance?

Look for discounts. Good student, safe driver, and bundling policies can help lower costs.

Is Comprehensive Insurance Necessary For New Drivers?

Comprehensive insurance is optional. It covers theft, vandalism, and natural disasters, not just collisions.

Are There Special Policies For Teenage Drivers?

Yes, many insurers offer policies tailored for young drivers. These may include higher premiums but specific benefits.

0 Comments