Student loans help many people go to college. They cover tuition, books, and other expenses. But finding the right loan can be hard. This guide helps you find the best resources for student loans.

Credit: studentaid.gov

Types of Student Loans

There are different types of student loans. Knowing them helps you choose the best one.

Federal Student Loans

Federal student loans come from the government. They have lower interest rates and flexible repayment plans.

- Direct Subsidized Loans: These loans are for students with financial need. The government pays the interest while you are in school.

- Direct Unsubsidized Loans: These loans are for all students. You pay the interest, even while in school.

- Direct PLUS Loans: These loans are for graduate students and parents. They have higher interest rates.

Private Student Loans

Private student loans come from banks or other lenders. They have higher interest rates and fewer repayment options.

- Bank Loans: Many banks offer student loans. Check your local bank for options.

- Credit Union Loans: Credit unions may offer better terms than banks.

Credit: www.reddit.com

Where to Find Student Loans

Now that you know the types of loans, let's find where to get them.

Fafsa

The Free Application for Federal Student Aid (FAFSA) is the first step. Fill it out to see if you qualify for federal loans.

Visit the FAFSA website to apply. It is free and easy to use.

School Financial Aid Office

Your school's financial aid office is a great resource. They can help you find loans and scholarships.

Online Lenders

Many online lenders offer student loans. Websites like SoFi and LendKey have good options.

Repayment Plans

Repaying your loan is important. Here are some common plans.

Standard Repayment Plan

This plan has fixed payments. You pay the same amount each month for 10 years.

Income-driven Repayment Plan

This plan adjusts your payments based on your income. It helps if you have a low salary.

Graduated Repayment Plan

This plan starts with low payments. The payments increase every two years.

Tips for Managing Student Loans

Managing student loans can be tough. Here are some tips to help.

Create A Budget

A budget helps you track your spending. It ensures you have money to repay your loan.

Make Extra Payments

If you can, make extra payments. This reduces the total interest you pay.

Stay In Touch With Your Lender

Always communicate with your lender. Let them know if you have trouble making payments.

Consider Loan Forgiveness Programs

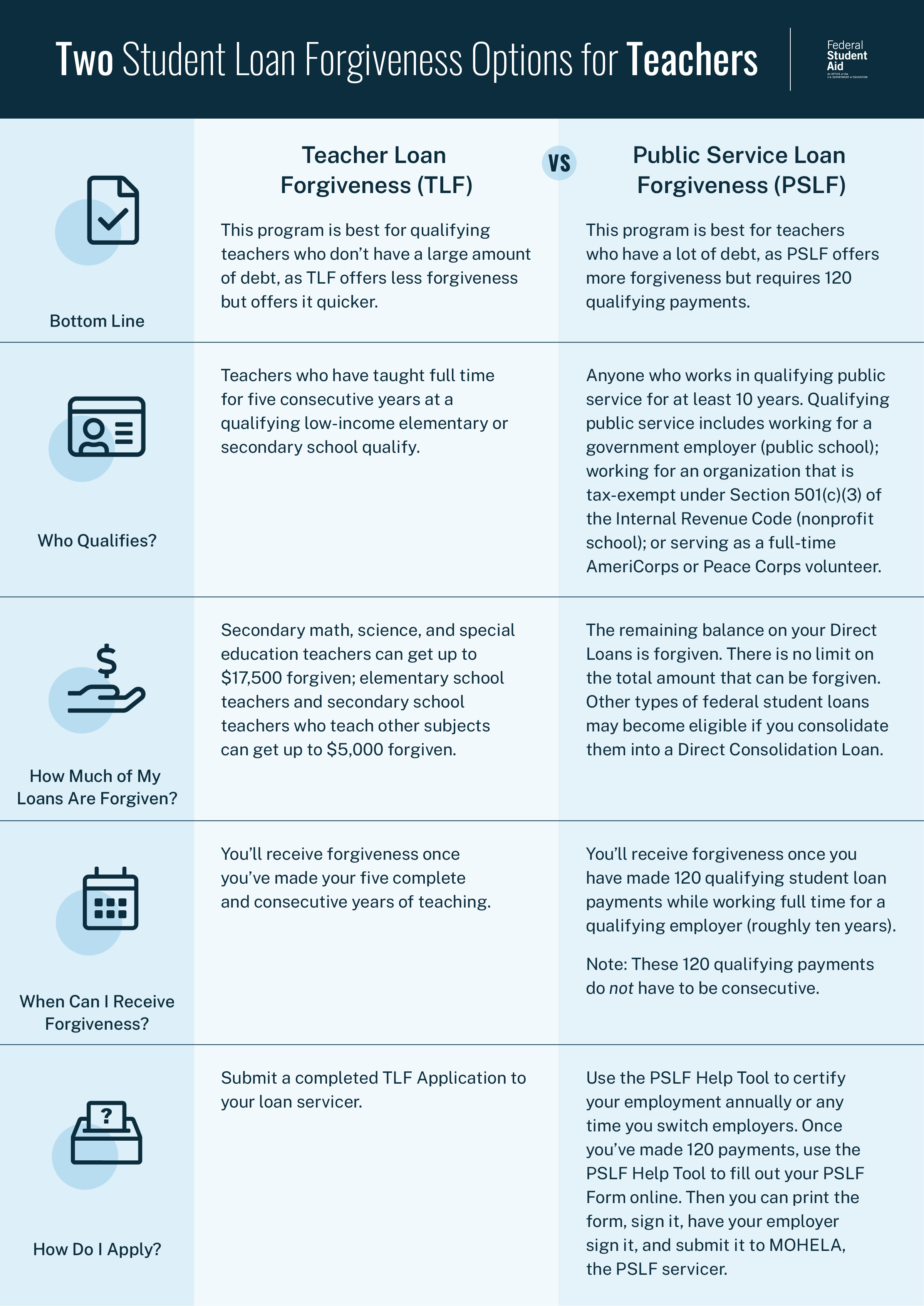

Some jobs offer loan forgiveness. Check if you qualify for programs like Public Service Loan Forgiveness.

Frequently Asked Questions

What Are The Best Federal Student Loans?

Federal loans like Direct Subsidized and Unsubsidized Loans are popular. They offer low rates.

How Do I Apply For Student Loans?

Fill out the Free Application for Federal Student Aid (FAFSA) online.

What Is The Interest Rate For Student Loans?

Rates vary. Federal loans have fixed rates. Private loans have variable rates.

Can Student Loans Be Forgiven?

Yes, certain federal loans can be forgiven. Public Service Loan Forgiveness is one option.

Conclusion

Student loans are a great way to pay for college. Knowing the best resources helps you make smart choices. Use this guide to find the right loan and repayment plan for you.

Remember to budget and communicate with your lender. These steps will help you manage your loans effectively.

Best Resources for Student Loans

Managing student loans can feel overwhelming, but the good news is that there are reliable resources available to guide you through every stage. From applying for aid to repayment and forgiveness, here are the best places to turn.

🎓 Federal Student Aid (FSA) – studentaid.gov

-

The official U.S. Department of Education site.

-

Best for: Applying for federal student loans, checking balances, learning about repayment plans, and applying for forgiveness.

-

Includes the FAFSA (Free Application for Federal Student Aid), which is the first step for most students seeking loans or grants.

💰 National Student Loan Data System (NSLDS)

-

Integrated into studentaid.gov now.

-

Best for: Tracking your federal loan details in one place (balances, servicers, repayment status).

-

Essential for staying organized and knowing exactly what you owe.

🏦 Loan Servicers (e.g., Nelnet, MOHELA, Aidvantage)

-

These companies handle billing and repayment for your federal loans.

-

Best for: Setting up payments, applying for income-driven repayment, and handling deferment or forbearance requests.

-

Contact your servicer directly if you’re struggling with payments.

📚 Consumer Financial Protection Bureau (CFPB) – consumerfinance.gov

-

A government watchdog agency.

-

Best for: Understanding your rights as a borrower, filing complaints against loan servicers, and exploring repayment guides.

-

Especially useful if you suspect errors or unfair practices.

🌍 State-Based Student Loan Agencies

-

Many states offer their own grants, scholarships, or loan repayment assistance programs, especially for teachers, healthcare workers, and public servants.

-

Best for: Supplemental aid beyond federal programs.

-

Example: New York’s Get on Your Feet Loan Forgiveness Program.

🎓 Nonprofit & Independent Resources

-

The Institute for College Access & Success (TICAS): Research and guides on reducing student debt.

-

National Foundation for Credit Counseling (NFCC): Provides counseling for debt management, including student loans.

-

Student Loan Borrower Assistance (SLBA): Legal resources and borrower rights information.

📱 Useful Tools & Calculators

-

Student Loan Simulator (on studentaid.gov): Helps you compare repayment plans.

-

Credible / NerdWallet / Student Loan Hero: Private-sector sites with calculators, refinancing comparisons, and borrower tips.

✅ Key Takeaways

-

Always start with federal resources first — they’re the most reliable and accurate.

-

Keep your loan servicer’s contact info handy for repayment and forgiveness paperwork.

-

Use nonprofit organizations and financial counseling if you feel lost or overwhelmed.

-

Explore state-specific programs for additional relief or forgiveness opportunities.

0 Comments