🏦 When Is the Best Time to Borrow from Your 401(k)?

Your 401(k) is one of the most powerful tools for building long-term financial security. It’s designed to help you live comfortably during retirement—but life doesn’t always go according to plan. Unexpected medical bills, urgent home repairs, or temporary financial gaps can make you wonder: Should I borrow from my 401(k)?

The answer isn’t a simple yes or no. Borrowing from your retirement account can sometimes make sense—but only under the right circumstances. Let’s break down when it’s actually a smart move and when it’s better to avoid it.

💡 What Does Borrowing from a 401(k) Mean?

When you take a 401(k) loan, you’re borrowing money from your own retirement savings and paying it back—with interest—into your own account.

Unlike traditional loans, you don’t go through a credit check, and the interest doesn’t go to a bank; it goes back to you.

Most plans allow you to borrow the lesser of:

-

50% of your vested balance, or

-

$50,000.

Repayment is usually required within five years, unless the loan is used to buy your primary home.

🕐 The Best Times to Borrow from Your 401(k)

1. When You’re Facing a True Financial Emergency

If you’re dealing with something serious—like preventing foreclosure, paying for emergency medical care, or fixing a major home issue—a 401(k) loan can be a practical short-term solution.

Since you’re borrowing your own money, it’s faster and often cheaper than high-interest credit cards or payday loans.

2. When You’re Avoiding High-Interest Debt

If you’re considering using a credit card with 20%+ interest, a 401(k) loan may save you a significant amount of money. The interest you pay on a 401(k) loan is usually much lower—and again, it goes back to your account.

3. When You Have a Clear, Short-Term Repayment Plan

A 401(k) loan works best when you know exactly how you’ll repay it—such as after receiving a tax refund, work bonus, or insurance payout.

Without a clear plan, you risk missing payments and turning the loan into taxable income (with penalties).

4. When You’re Secure in Your Job

If you’re confident about your employment stability, the risk of being forced to repay the loan early is low.

However, if you leave or lose your job, the unpaid balance typically must be repaid within 60–90 days—or it’ll be treated as a withdrawal, triggering taxes and a 10% penalty if you’re under 59½.

🚫 When You Should Avoid Borrowing from Your 401(k)

-

For luxury spending like vacations or electronics.

-

When you’re behind on retirement savings. It slows your compounding growth.

-

If you’re planning to switch jobs soon. You could be forced to repay immediately.

-

When other low-cost loan options are available. A credit union or personal loan may be better.

📉 The Hidden Costs

Even though it’s your own money, taking a 401(k) loan means missing out on potential market growth.

While that money is out, it’s not invested—and if the market performs well, your retirement fund may lag behind where it could have been.

✅ Smarter Alternatives to Consider

Before touching your retirement account, explore:

-

Building an emergency fund (3–6 months of expenses).

-

Applying for a low-interest personal loan or credit union loan.

-

Taking up a temporary side income to cover short-term needs.

🧭 Final Thoughts

The best time to borrow from your 401(k) is when you absolutely need to, and you have a solid plan to repay quickly. It should be a last resort—not a regular financial tool.

Used wisely, a 401(k) loan can help you navigate short-term financial challenges. Used carelessly, it can undermine years of disciplined saving and compound interest.

Before making any decision, talk to a financial advisor to understand the full impact on your future. Remember: your 401(k) is your future security—protect it carefully.

Borrowing from your 401K is a big decision. It affects your retirement funds. You need to think carefully before you borrow. When is the best time to borrow from your 401K? This article will help you understand.

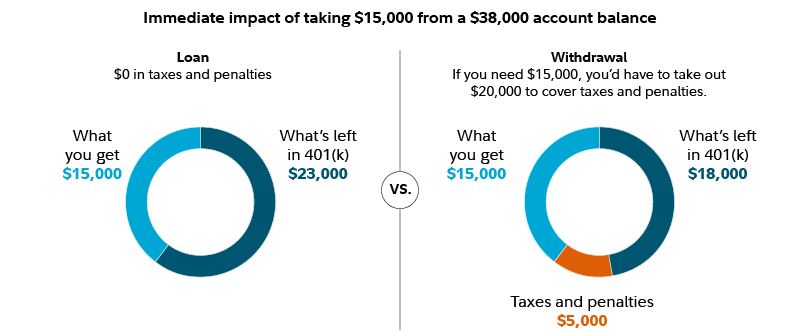

Credit: www.fidelity.com

What is a 401K?

A 401K is a retirement savings plan. It is offered by employers. You save money from your paycheck. Your employer may also add money. This plan helps you save for retirement.

Can You Borrow from Your 401K?

Yes, you can borrow from your 401K. Many plans allow loans. You borrow money from yourself. You pay it back with interest. The interest goes back into your account. But, there are rules to follow.

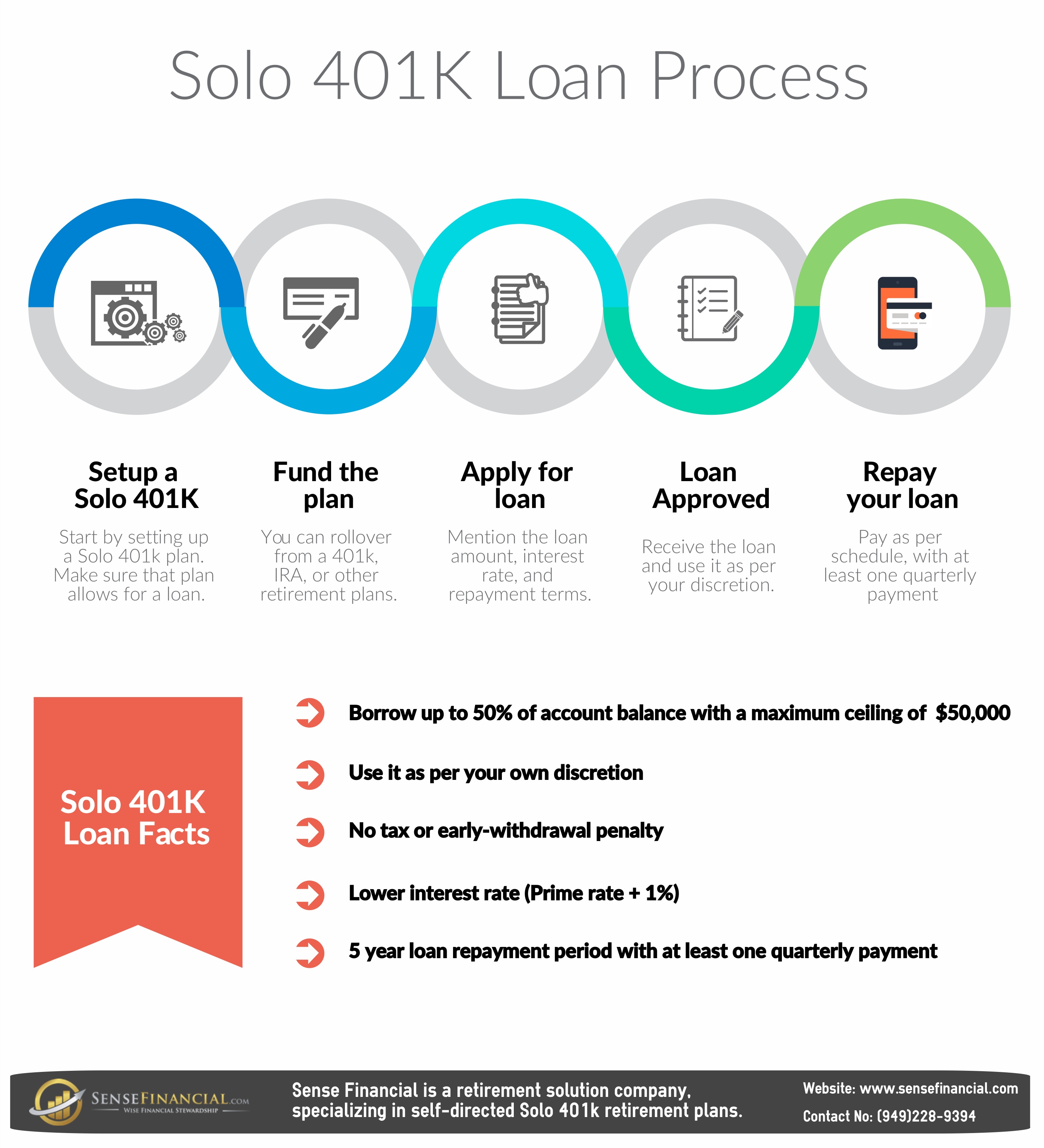

Credit: www.sensefinancial.com

Why Would You Borrow from Your 401K?

People borrow from their 401K for many reasons. They may need money for emergencies. They may need money for big expenses. Some common reasons are:

- Paying medical bills

- Buying a house

- Paying off high-interest debt

- Covering education costs

When is the Best Time to Borrow?

Borrowing from your 401K is not always a good idea. You need to think about your situation. Here are some times when borrowing might be okay:

1. For Emergencies

Emergencies happen. You might have medical bills. You might need to fix your house. If you have no other options, borrowing can help.

2. To Avoid High-interest Debt

High-interest debt can be hard to pay off. Credit card debt is a good example. Borrowing from your 401K can be cheaper. You pay yourself back. The interest is usually lower.

3. For A Major Purchase

Buying a house is a big expense. You might need more money. Borrowing from your 401K can help. It might be better than getting a loan from the bank.

4. For Education Costs

Education is important. It can be expensive. Borrowing from your 401K can help pay for school. This can be a good investment in your future.

When Should You Avoid Borrowing?

Borrowing from your 401K is not always smart. There are times when you should avoid it. Here are some examples:

1. If You Are Near Retirement

If you are close to retirement, borrowing is risky. You need your savings. You might not have time to pay it back. This can hurt your retirement plans.

2. If You Can Get A Loan Elsewhere

Sometimes it is better to get a loan from the bank. If you can get a low-interest loan, it might be smarter. This way, you keep your retirement savings safe.

3. If You Are Not Sure About Paying Back

Paying back your 401K loan is important. If you are not sure you can do it, don't borrow. Missing payments can be costly. You might have to pay taxes and penalties.

How to Borrow from Your 401K

If you decide to borrow, follow these steps:

- Check your plan rules. Not all plans allow loans.

- Decide how much you need. Only borrow what you need.

- Fill out the loan application. Your employer can help.

- Pay back the loan. Follow the repayment plan.

Pros and Cons of Borrowing from Your 401K

Borrowing from your 401K has pros and cons. It is important to know both.

Pros:

- Easy access to funds

- Lower interest rates

- No credit check

- Interest goes back to your account

Cons:

- Reduces retirement savings

- Missed investment growth

- Repayment risks

- Possible taxes and penalties

Frequently Asked Questions

What Is A 401k Loan?

A 401K loan is money borrowed from your retirement account.

How Much Can I Borrow From My 401k?

You can borrow up to 50% of your balance, with a max of $50,000.

Is Borrowing From 401k A Good Idea?

It depends on your financial situation. Consider fees and taxes.

What Are The Risks Of A 401k Loan?

You may face penalties and taxes if not repaid.

Conclusion

Borrowing from your 401K can be helpful. But, it is not always the best choice. Think about your situation. Consider other options. Make sure you can pay it back. Protect your retirement savings. Be careful and smart.

0 Comments